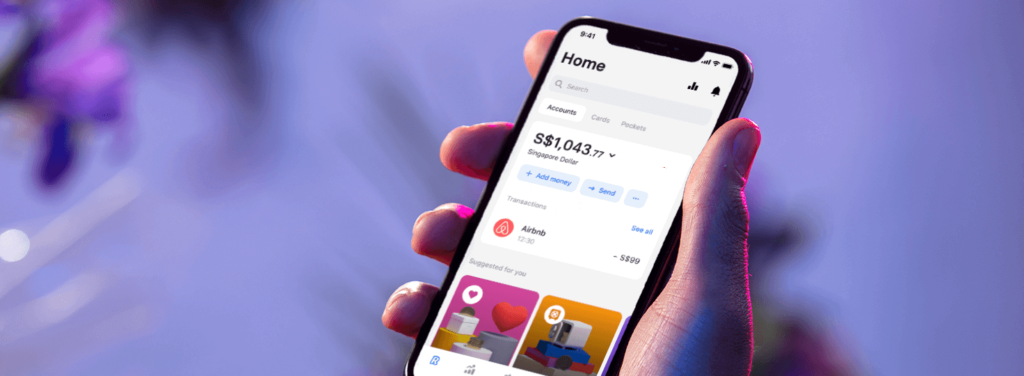

Unlock Financial Freedom With Revolut: Strategies For Smart Money Management

Financial freedom is more than a buzzword—it’s the dream of having enough resources to live comfortably without constant financial stress. In today’s dynamic economic environment, managing your money effectively can seem overwhelming. Fortunately, with the right tools and strategies, achieving financial independence is not only possible but also manageable. One tool that stands out in this regard is Revolut. This cutting-edge financial app can transform the way you handle your money, paving the way to financial freedom.

Understanding Financial Freedom

Financial freedom goes beyond merely having a large bank balance. It means having the flexibility to make life choices without financial constraints. It encompasses security, peace of mind, and the ability to pursue your passions without worrying about money. Achieving financial freedom involves creating a sustainable lifestyle where your financial needs and goals are met without stress.

How Revolut Supports Your Financial Journey

Revolut isn’t just a digital bank account; it’s a versatile financial platform designed to help you take control of your finances. With features that span budgeting, saving, investing, and spending, Revolut equips you with the tools needed for effective money management. Here’s how you can use Revolut to work towards financial freedom:

Building a Strong Financial Foundation

Setting Clear Financial Goals

To achieve financial freedom, start by setting specific, measurable goals. Whether it’s buying a home, starting a business, or building an emergency fund, having clear objectives will keep you motivated. Break down your long-term goals into smaller, actionable steps. For example, if you want to buy a house in five years, set interim goals such as saving for a down payment, improving your credit score, and researching mortgage options.

Creating a Realistic Budget

A well-structured budget is essential for financial planning. Revolut’s budgeting tools simplify this process by allowing you to track your income and expenses seamlessly. Categorize your spending to identify areas where you can cut back, and allocate funds toward your savings and investment goals. A budget isn’t about limiting your lifestyle; it’s about gaining control and making informed financial decisions.

Mastering Your Spending Habits

Analyzing Your Spending

Revolut provides detailed spending analytics to help you understand your financial behavior. By analyzing where your money goes, you can identify patterns of overspending and find opportunities to reduce unnecessary expenses. Utilize features like cash-back rewards and loyalty programs to get more value from your spending.

Practical Tips for Smart Spending

Beyond just budgeting, optimize your spending habits. Look for discounts, use coupons, and take advantage of loyalty programs. Consider cooking at home more often instead of dining out and exploring free or low-cost entertainment options. Small adjustments can lead to significant savings over time.

Growing Your Wealth

Investing Wisely

Investing is a key component of financial freedom. Revolut offers a variety of investment options, including stocks, cryptocurrencies, and ETFs. Start by educating yourself about different investment strategies and understanding your risk tolerance. For beginners, consulting a financial advisor can be beneficial. Diversify your investments to manage risk and maximize returns.

Leveraging Automated Savings

One of Revolut’s standout features is the round-up savings tool. Each time you make a purchase, Revolut rounds up the amount to the nearest dollar and transfers the difference to your savings account. Over time, these small increments can accumulate into a significant sum, helping you save effortlessly.

Maximizing Your Money

Smart Spending and Savings Strategies

To accelerate your path to financial freedom, focus on maximizing every dollar. Look for opportunities to save on everyday expenses, such as using cashback apps and negotiating bills. Additionally, Revolut’s features can help you save on international transactions. Holding multiple currencies in your Revolut account avoids costly exchange fees and makes managing travel expenses easier.

Utilizing Revolut’s Unique Features

Revolut offers several features designed to enhance your financial management. Use its multi-currency accounts to avoid foreign exchange fees when traveling or shopping internationally. The app also facilitates peer-to-peer payments, eliminating the need for cash and making transactions more convenient.

Overcoming Common Financial Challenges

Building an Emergency Fund

An emergency fund is crucial for managing unexpected expenses. Aim to save three to six months’ worth of living expenses in a dedicated account. Revolut’s savings vaults are ideal for setting aside money specifically for emergencies, helping you stay prepared for financial setbacks.

Managing Debt Effectively

Debt can hinder your journey to financial freedom. Develop a debt repayment strategy, focusing on high-interest debts first. Consider options like debt consolidation if necessary to simplify your repayment process and reduce interest rates.

Conclusion

Achieving financial freedom is a continuous journey that requires discipline, patience, and the right tools. Revolut can be a powerful ally in this endeavor. By setting clear financial goals, creating and sticking to a budget, mastering your spending habits, and making informed investment decisions, you can take control of your financial future. Remember, small, consistent steps can lead to significant achievements. Start today, and with Revolut’s support, you’ll be well on your way to unlocking your financial freedom.

Ready to take the first step towards financial independence? Sign up for Revolut and start your journey today!

Remember

- Stay Consistent: Regularly review your financial goals and adjust your strategies as needed. Consistency is key to long-term success.

- Educate Yourself: Continuously educate yourself about personal finance. The more you know, the better decisions you can make.

- Seek Professional Advice: Don’t hesitate to seek advice from financial advisors or professionals, especially when making significant investment decisions.

- Be Patient: Financial freedom doesn’t happen overnight. Stay patient and persistent, and celebrate your progress along the way.

Take control of your finances, stay informed, and enjoy the journey to financial freedom!

P.S. Would you like tailored financial advice? Let me know what you need in the comments, and we’ll help you locate the best strategies for achieving financial freedom!